All Categories

Featured

Table of Contents

- – What does Level Death Benefit Term Life Insura...

- – How can Level Term Life Insurance Policy Optio...

- – What happens if I don’t have 30-year Level Te...

- – Who offers flexible Level Death Benefit Term ...

- – Who provides the best Tax Benefits Of Level ...

- – What is the best Compare Level Term Life Ins...

Adolescent insurance coverage offers a minimum of security and can give protection, which could not be available at a later date. Quantities supplied under such protection are generally minimal based upon the age of the kid. The current restrictions for minors under the age of 14.5 would certainly be the greater of $50,000 or 50% of the amount of life insurance policy active upon the life of the applicant.

Adolescent insurance might be sold with a payor advantage motorcyclist, which gives for waiving future premiums on the youngster's plan in case of the death of the person who pays the premium. Elderly life insurance coverage, occasionally referred to as rated fatality benefit plans, gives eligible older candidates with minimal entire life coverage without a medical exam.

The maximum problem quantity of protection is $25,000. These plans are normally much more expensive than a totally underwritten policy if the person qualifies as a basic threat.

Our term life alternatives include 10, 15, 20, 25, 30, 35, and 40-year plans. One of the most prominent kind is level term, suggesting your payment (premium) and payout (survivor benefit) stays degree, or the very same, till completion of the term period. This is the most uncomplicated of life insurance coverage choices and calls for really little maintenance for plan proprietors.

What does Level Death Benefit Term Life Insurance cover?

You can provide 50% to your partner and split the remainder among your adult youngsters, a parent, a close friend, or even a charity. Level term life insurance. * In some instances the survivor benefit may not be tax-free, learn when life insurance policy is taxable

1Term life insurance coverage supplies momentary security for an essential period of time and is generally more economical than irreversible life insurance. 2Term conversion standards and restrictions, such as timing, might use; as an example, there might be a ten-year conversion benefit for some items and a five-year conversion advantage for others.

3Rider Insured's Paid-Up Insurance coverage Purchase Option in New York. There is a cost to exercise this biker. Not all participating policy owners are qualified for returns.

How can Level Term Life Insurance Policy Options protect my family?

We might be made up if you click this advertisement. Ad Level term life insurance policy is a plan that provides the very same survivor benefit at any kind of factor in the term. Whether you die on the exact same day you obtain a policy or the last, your beneficiaries will certainly receive the very same payment.

Which one you choose relies on your needs and whether or not the insurer will approve it. Plans can likewise last till specified ages, which most of the times are 65. Since of the numerous terms it offers, degree life insurance policy provides prospective policyholders with flexible choices. Beyond this surface-level info, having a greater understanding of what these plans involve will help guarantee you buy a plan that fulfills your requirements.

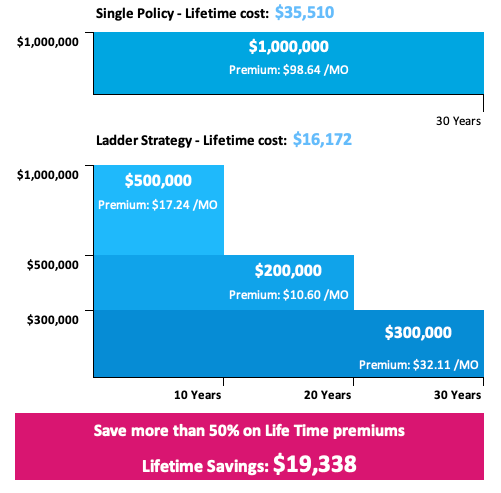

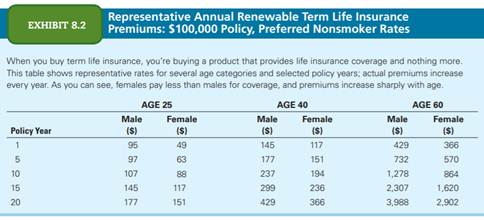

Be mindful that the term you choose will certainly affect the costs you spend for the plan. A 10-year level term life insurance policy policy will certainly cost less than a 30-year plan due to the fact that there's less possibility of an occurrence while the plan is active. Reduced risk for the insurance firm corresponds to lower premiums for the insurance policy holder.

What happens if I don’t have 30-year Level Term Life Insurance?

Your family members's age ought to likewise affect your plan term option. If you have little ones, a longer term makes feeling due to the fact that it shields them for a longer time. If your youngsters are near their adult years and will be economically independent in the close to future, a shorter term could be a better fit for you than a prolonged one.

Nevertheless, when comparing entire life insurance coverage vs. term life insurance, it's worth keeping in mind that the latter usually expenses less than the previous. The result is more coverage with lower costs, providing the most effective of both globes if you need a significant quantity of coverage yet can't afford a much more expensive plan.

Who offers flexible Level Death Benefit Term Life Insurance plans?

A degree death advantage for a term plan normally pays as a round figure. When that occurs, your successors will receive the whole quantity in a single settlement, which amount is not taken into consideration income by the IRS. For that reason, those life insurance policy earnings aren't taxed. Nevertheless, some degree term life insurance companies allow fixed-period repayments.

Rate of interest payments got from life insurance plans are taken into consideration earnings and are subject to taxes. When your degree term life policy runs out, a couple of various things can happen.

The downside is that your eco-friendly level term life insurance will feature higher costs after its preliminary expiration. Advertisements by Money. We might be compensated if you click this advertisement. Advertisement For beginners, life insurance coverage can be complicated and you'll have concerns you desire addressed before devoting to any type of policy.

Who provides the best Tax Benefits Of Level Term Life Insurance?

Life insurance policy business have a formula for computing threat making use of death and interest. Insurance providers have countless customers obtaining term life plans simultaneously and utilize the costs from its energetic plans to pay making it through beneficiaries of various other plans. These business utilize mortality tables to estimate just how several people within a certain group will submit fatality claims per year, and that details is used to determine ordinary life span for potential insurance policy holders.

Additionally, insurance companies can invest the cash they get from premiums and boost their earnings. The insurance policy business can spend the cash and make returns - Level term life insurance companies.

The complying with section details the advantages and disadvantages of level term life insurance policy. Predictable premiums and life insurance policy coverage Simplified policy framework Prospective for conversion to irreversible life insurance policy Minimal protection duration No cash value build-up Life insurance premiums can enhance after the term You'll discover clear advantages when comparing level term life insurance policy to other insurance coverage types.

What is the best Compare Level Term Life Insurance option?

From the moment you take out a plan, your costs will certainly never ever alter, assisting you plan financially. Your insurance coverage won't differ either, making these plans reliable for estate preparation.

If you go this path, your premiums will certainly increase yet it's constantly excellent to have some versatility if you desire to keep an energetic life insurance coverage plan. Renewable degree term life insurance policy is an additional option worth taking into consideration. These policies permit you to keep your existing strategy after expiration, supplying adaptability in the future.

Table of Contents

- – What does Level Death Benefit Term Life Insura...

- – How can Level Term Life Insurance Policy Optio...

- – What happens if I don’t have 30-year Level Te...

- – Who offers flexible Level Death Benefit Term ...

- – Who provides the best Tax Benefits Of Level ...

- – What is the best Compare Level Term Life Ins...

Latest Posts

Cost Of Burial Insurance

Instant Term Life Insurance Quotes Online

Best Burial Insurance Policies

More

Latest Posts

Cost Of Burial Insurance

Instant Term Life Insurance Quotes Online

Best Burial Insurance Policies