All Categories

Featured

Table of Contents

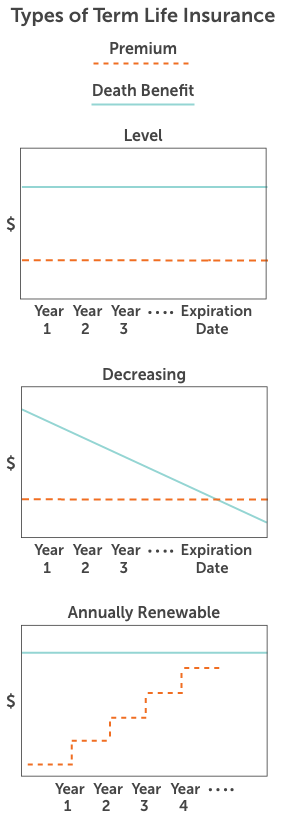

A level term life insurance policy policy can provide you satisfaction that the individuals that rely on you will certainly have a death advantage throughout the years that you are intending to sustain them. It's a method to help take care of them in the future, today. A degree term life insurance policy (often called degree costs term life insurance coverage) plan gives coverage for an established variety of years (e.g., 10 or twenty years) while keeping the costs repayments the very same for the period of the policy.

With degree term insurance coverage, the price of the insurance will stay the exact same (or potentially lower if returns are paid) over the term of your plan, typically 10 or two decades. Unlike long-term life insurance policy, which never runs out as lengthy as you pay costs, a level term life insurance policy plan will certainly finish eventually in the future, generally at the end of the period of your level term.

What is Level Term Life Insurance? Explained in Simple Terms?

As a result of this, many people utilize long-term insurance policy as a steady financial planning tool that can serve several needs. You might be able to convert some, or all, of your term insurance coverage during a set duration, commonly the initial one decade of your plan, without requiring to re-qualify for coverage also if your wellness has transformed.

As it does, you might want to include in your insurance policy coverage in the future. When you initially obtain insurance, you might have little cost savings and a huge home loan. Eventually, your savings will expand and your home mortgage will diminish. As this occurs, you may intend to ultimately minimize your fatality benefit or think about transforming your term insurance to a permanent policy.

Long as you pay your costs, you can rest simple recognizing that your enjoyed ones will certainly get a fatality benefit if you pass away throughout the term. Many term policies enable you the ability to convert to irreversible insurance policy without having to take an additional wellness test. This can allow you to benefit from the additional advantages of a permanent plan.

Degree term life insurance policy is among the most convenient courses right into life insurance policy, we'll review the advantages and disadvantages to make sure that you can pick a plan to fit your needs. Degree term life insurance policy is the most typical and standard kind of term life. When you're seeking short-term life insurance policy strategies, degree term life insurance policy is one course that you can go.

You'll fill out an application that includes basic individual information such as your name, age, etc as well as a more thorough set of questions concerning your clinical history.

The short response is no. A degree term life insurance policy plan does not develop cash worth. If you're seeking to have a policy that you have the ability to withdraw or obtain from, you may check out permanent life insurance policy. Entire life insurance plans, for instance, allow you have the convenience of fatality benefits and can accumulate cash worth with time, indicating you'll have a lot more control over your advantages while you live.

How Does Short Term Life Insurance Benefit Families?

Riders are optional arrangements included in your plan that can provide you fringe benefits and protections. Motorcyclists are a fantastic way to include safeguards to your policy. Anything can occur throughout your life insurance term, and you intend to await anything. By paying simply a little bit a lot more a month, motorcyclists can offer the assistance you need in situation of an emergency situation.

This biker provides term life insurance policy on your children through the ages of 18-25. There are instances where these benefits are constructed into your policy, however they can additionally be readily available as a different enhancement that calls for added repayment. This cyclist provides an added survivor benefit to your beneficiary should you die as the result of an accident.

Latest Posts

Cost Of Burial Insurance

Instant Term Life Insurance Quotes Online

Best Burial Insurance Policies